nebraska car sales tax form

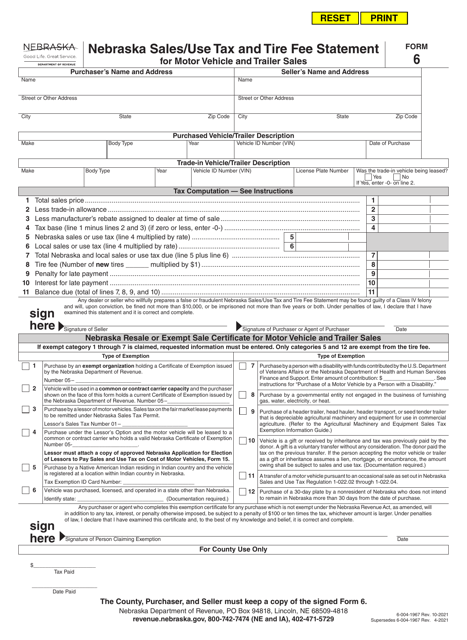

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The sales price on line 1 must include amounts for destination charges import custom fees surcharges.

Tax Form Templates 5 Free Examples Fill Customize Download

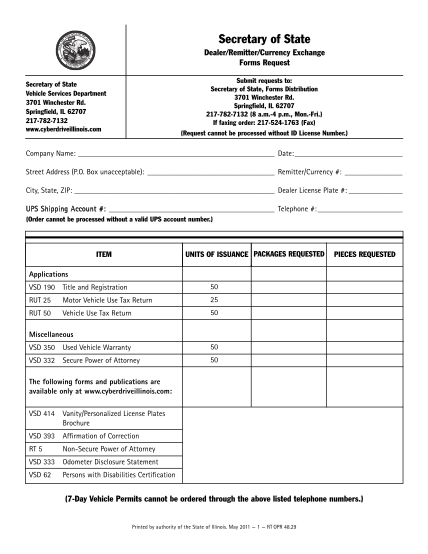

Sales Tax and Use Forms are referred to as Form 6 in Nebraska.

. PURCHASERS NAME AND ADDRESS SELLERS NAME AND ADDRESS. IRS Form W-9 Request for Taxpayer Identification Number and Certification. Sales and Use Tax Forms - Nebraska Department of.

Download Nebraska blank vehicle sales tax form Information. The lessor must issue a Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6. 32 Mbits Files in category.

Transferring Your NE Title. Must hold a Nebraska Sales Tax Permit. Vehicle Title Registration.

Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. 301 Centennial Mall South PO Box 94789 Lincoln NE 68509- 4789 402 471-3918 State of Nebraska. When a motor vehicle dealer.

Printable Nebraska Sales Tax Exemption Certificates Underpayment of sales or use tax or tire fee on this statement must be. 249 out of 1215 Download speed. The Nebraska state sales and use tax rate is 55 055.

To sign a Nebraska sales tax for motor vehicle and trailer sales form right from your iPhone or iPad just follow these brief guidelines. 249 out of 1215 Download speed. There are no changes to local sales and use tax rates that are effective July 1 2022.

Information regarding Nebraska Drivers Licenses IDs or permits. Nebraska SalesUse Tax and Tire Fee Statement. Additional fees collected and their distribution for every motor vehicle registration issued are.

Effective April 1 2022 the city of. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Motor Vehicle Dealer Exercises the Buy-out.

Nebraska sales tax form March 24 2022 Posted by warthunder br changes 2022 where is villa del palmar located. Bottom of the Form 6 if e-filing Nebraska and Local Sales and Use Tax Return Form 10 or with Form 10 if filing on paper. A completed Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6.

50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human. Businesses may become licensed. Ad Download Or Email Form 6 More Fillable Forms Try for Free Now.

Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Two signed copies must be given to the purchaser.

Nebraska sales tax permit and must file a nebraska and local sales and use tax return form 10 on or before the due date. Nebraska vehicle sales tax form. To title and register your car with the Nebraska DMV visit your local county registrars office within 30 days of the sale date.

You must complete a Nebraska Tax Application Form 20 to apply for a sales tax permit. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department. In addition to taxes car.

Nebraska Vehicle Registration Paperwork. How to Obtain a Permit. IRS 2290 Form for Heavy Highway Vehicle Use Tax.

Nebraska Forms Nebraska Department of Revenue. Nebraska vehicle sales tax form. For vehicles that are being rented or leased see see taxation of leases and rentals.

Department of Motor Vehicles. Nebraska vehicle title and registration resources. Avalara Returns for Small Business can easily automate the sales tax filing process.

The Seller must also provide the buyer with a Bill of Sale or a completed Nebraska Department of Revenue Form 6 Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle And. After the application has been. 2022 annual tax sale procedures.

Form 6XN is available at each county treasurers office and the. For Motor Vehicle and Trailer Sales. To sign over the Nebraska vehicle title you and the buyer.

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Fill Free Fillable Forms For The State Of Nebraska

2014 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Ne Dor Form 6 2018 2022 Fill Out Tax Template Online Us Legal Forms

2005 Ne Form 13 Fill Online Printable Fillable Blank Pdffiller

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Free Nebraska Motor Vehicle Dmv Bill Of Sale Form Pdf

Free Sales Receipt Template Word Pdf Eforms

Nebraska Motor Vehicle Bill Of Sale Form Pdfsimpli

109 Vehicle Bill Of Sale Form Page 6 Free To Edit Download Print Cocodoc

2005 Ne Form 13 Fill Online Printable Fillable Blank Pdffiller

Tax Form Templates 5 Free Examples Fill Customize Download

Fill Free Fillable Forms For The State Of Nebraska

Fill Free Fillable Forms For The State Of Nebraska

28 Printable Motor Vehicle Bill Of Sale Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Fill Free Fillable Forms For The State Of Nebraska

All About Bills Of Sale In Nebraska The Forms And Facts You Need