accumulated earnings tax calculation

A personal service corporation PSC may accumulate earnings up to 150000 without having to pay this tax. Tax Rate and Interest If a corporation accumulates earnings that exceed the exemption amounts an accumulated earnings tax of 20 15 prior to 2013 of the excess earnings may be assessed.

What Are Accumulated Earnings Profits Accounting Clarified

On the IRS examiners checklist is a question to consider Accumulated Tax.

. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue Code. We have noticed an increase in IRS examinations of C Corporations. Accumulated Earnings Tax Calculation.

The tax is assessed at the highest individual tax rate on the corporations accumulated income and is in addition to the regular corporate income tax. The regular corporate income tax. For example lets assume a certain company has 100000 in accumulated earnings at the beginning of the year.

Using the Bardahl formula Xestimated it will cost 25 cash to complete an operating cycle. Restaurants In Matthews Nc That Deliver. Constructive Distributions Below-market loans.

Accumulated Earnings Tax Distributions to Shareholders Money or Property Distributions Amount distributed. Gain from property distributions. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

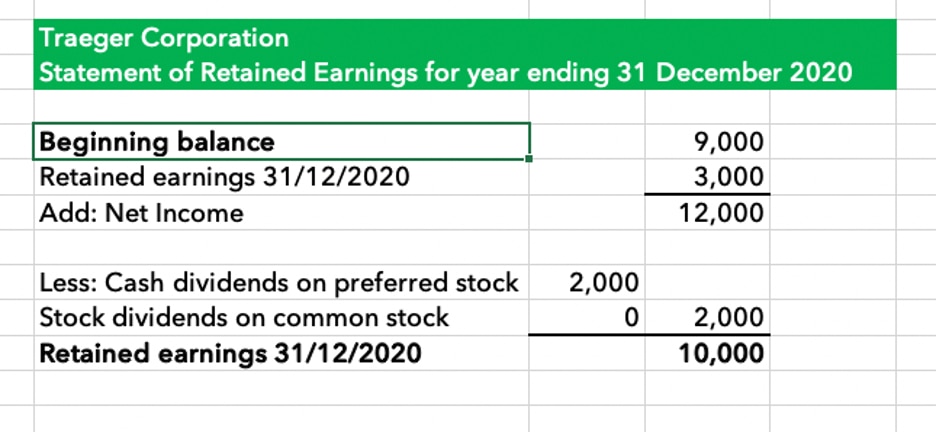

The calculation of accumulated retained earnings is as follows. The tax is assessed by the IRS rather than self-assessed. Yorkie Poo Life Expectancy.

Calculation of Accumulated Earnings. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. Virginia Hybrid Tax Credit.

Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and profits to accumulate rather than being paid out. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its shareholders by permitting earnings and profits to accumulate instead of being divided or distributed. Income Tax Rate.

Hence wealthy individuals formed holding companies specifically to hold investments so that the investment income would be taxed at the lower rate. RE Initial RE net income dividends. A distribution from a corporation is a dividend to the extent of the corporations current.

Beginning retained earnings Current period profitslosses - Current period dividends Accumulated retained earnings Terms Similar to Accumulated Retained Earnings Accumulated retained earnings is also known as earned surplus or unappropriated profit. 531 and 532. A Personal Services Company PSC can make profits of up to 150000 without having to pay these fees.

Majestic Life Church Service Times. In its budget Xset aside 35 of cash to finance acquisitions it. Expenses of issuing a stock dividend.

Charitable contributions and any net. Keep in mind that this is not a self-imposed tax. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

In general a corporations current-year EP is calculated by making adjustments to its taxable income for the year for items that are treated differently for EP purposes. An S corporation with accumulated EP may be subject to corporate level tax on its excess passive investment income. Restaurants In Erie County Lawsuit.

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Ad Bark Does the Legwork to Find Great Prices on Local Tax Returns. Corporation cancels shareholders debt.

Samantha 600 Lb Life Youtube. Tax Abatement Meaning In English. It compensates for taxes which cannot be levied on dividends.

Accumulated Earnings Tax Accumulated Taxable Income 20 Personal Holding Company Tax In times past the tax rate on individuals was considerably higher than on corporations. If an S corporation with accumulated EP at the end of three consecutive tax. Accumulated earnings penalty is accumulated taxable income.

The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and foreign income taxes. Are Dental Implants Tax Deductible In Ireland. The company made 700000 in net profits and paid dividends worth 300000 in the same year.

Bardahl Formula Calculator - Refute IRS Accumulated Earnings Assertions Use the Bardahl Formula Calculator to avoid and defend against Accumulated Earnings Tax. The adjustments include a deduction for federal income taxes paid. Download the program now.

Distributions of Stock or Stock Rights Constructive stock distributions. Opry Mills Breakfast Restaurants. At the end of year 1 it had 100 of accumulated earnings 40 of which will be paid as a dividend.

The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. A corporation determines this amount by adjusting its taxable income for economic items to better reflect how much cash it has available to make dividend distributions. Calculating the Accumulated Earnings The formula for calculating retained earnings RE is.

Download Avalara sales tax rate tables by state or search tax rates by individual address. The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

TaxInterest is the standard that helps you calculate the correct amounts. An IRS review of a business can impose it. A corporation may be allowed an accumulated earnings credit in the na-ture of a deduction in computing accu-mulated taxable income to the.

Corporate Tax Increase Canada. This figure is calculated as EP at the beginning of the year plus current EP minus distributions to shareholders during the current period. C corporations can earn up to 250000 without incurring accumulated earning tax.

Accumulated Earnings Tax Calculation.

Earnings And Profits Computation Case Study

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Earnings And Profits Computation Case Study

Excel Formula Income Tax Bracket Calculation Exceljet

Determining The Taxability Of S Corporation Distributions Part Ii

Determining The Taxability Of S Corporation Distributions Part Ii

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

What Are Retained Earnings Quickbooks Australia

Earnings And Profits Computation Case Study

What Are Retained Earnings Bdc Ca

Determining The Taxability Of S Corporation Distributions Part I